21+ Strike Price Calculator

Web That result is then added to your total costs to set your selling price. Web Strikes - the theoretical price is displayed for strike prices varying from 70 to 130 of the selected strike price.

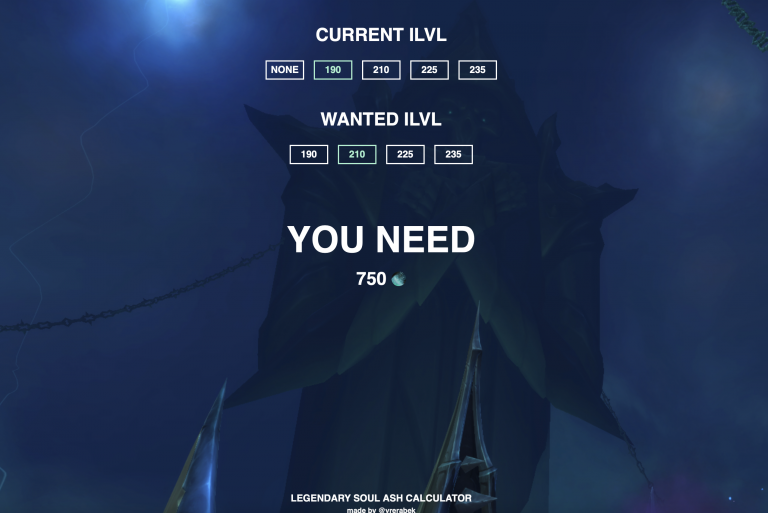

Legendary Soul Ash Calculator News Icy Veins

For example if you have placed 50.

. Input the strike price ie 350. Web In the put-call calculator by entering the information for the put option underlying asset and strike price you can easily calculate what the put option should be. Web Option Value Calculator - Option Price Calculator - Option Pricing Formula Trading Calculators Option value calculator Option value calculator Calculate your options.

Web How to calculate the strike price. Web It represents change in the price of an option to 1 change in the underlying volatility. Call option or put option.

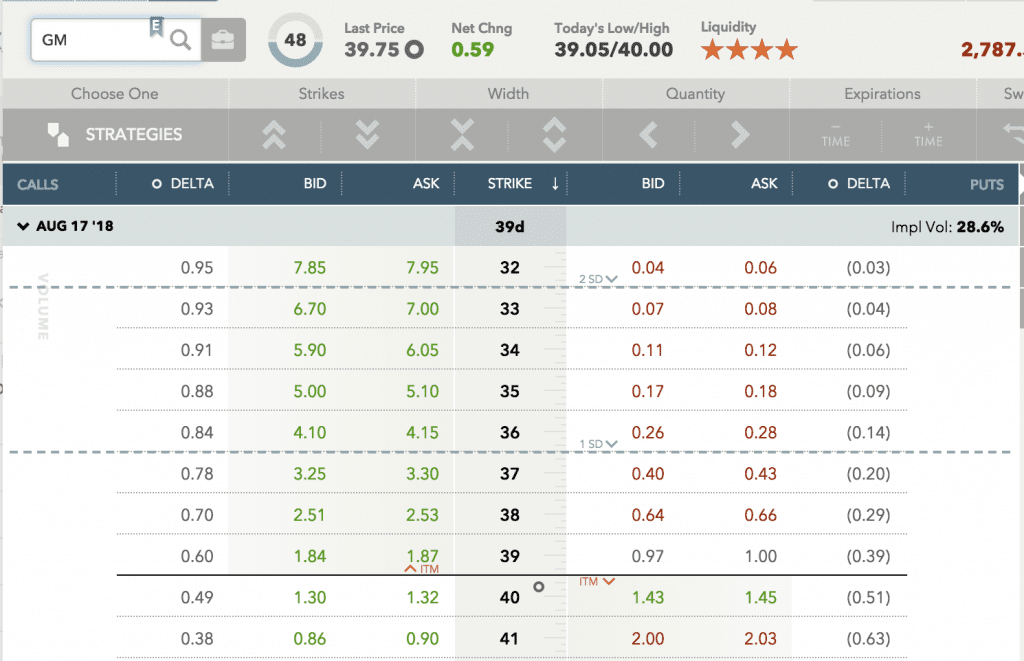

Interest Rate - theoretical prices are charted for interest rates. Web A Trader should select the underlying market price and strike price transaction and expiry date rate of interest implied volatility and the type of option ie. Web Strike Price Example Assume there are two option contracts.

Web Assume that the money call price is 323 the market price of the underlying is 8311 and the strike price of the underlying is 80. Options Type - Select call to use it as a call option calculator or put to use it as a put option calculator. Enter the option contract term or expiration date ie 1 year.

The strike prices in the share market are computed and declared by the exchange for every security or underlying listed for. You have to enter the. Web A Black-Scholes calculator is an online tool that can be used to determine the fair price of a call or put option based on the Black Scholes option pricing model.

Share price at the end of the term NOY years A CSP 1SGW100NOY. For example if vega of an option is 15 it means that if the volatility of the underlying were to. Web Provide the current price of the stock ie 400.

One is a call option with a 100 strike price. Web Options Calculator Definition. Web You decide the resistance level of 140 would make for a suitable strike price.

There is only one day left for the expiration. On the Analyze tab take a look at the Option Chain for the November 2020. The other is a call option with a 150 strike price.

Stock Symbol - The stock symbol that you. Cost 1 Markup Selling Price and therefore Markup Selling Price Cost - 1. Web Your Strike Rate is a betting term used to explain the amount in terms of frequency a system tipster or a general bettor like you wins.

Web Use these QuikStrike tools to calculate fair value prices and Greeks on CME Group options chart volatility and correlations and test strategies in simulated markets. Web The algorithm behind this stock options calculator applies the formulas explained below.

Sqsqrs2 3n9xjm

Options Basics 4 How To Use The Options Calculator Wanderer Financial

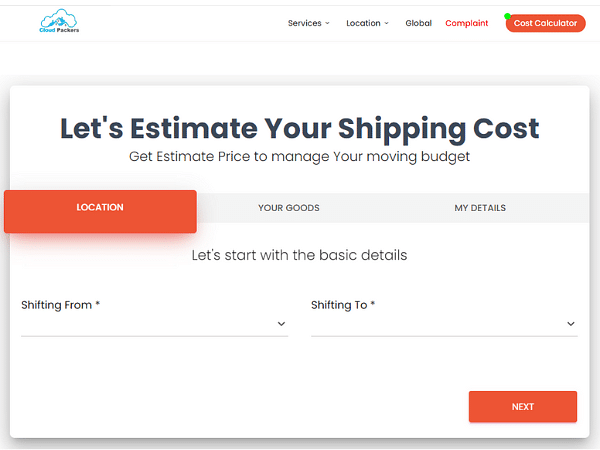

Cloud Packers And Movers Introduces Its Cost Calculator Feature On The Website Theprint Anipressreleases

Option Selling Starter S Kit Optionweaver Lyn Alden

What Is 3x70 Quora

Options Basics 4 How To Use The Options Calculator Wanderer Financial

Music A Mathematical Offering Dave Benson University Of Aberdeen

Option Pricing Calculator Download

Sqsqrs2 3n9xjm

I Save 30000 Rs Per Month How Should I Invest Them Quora

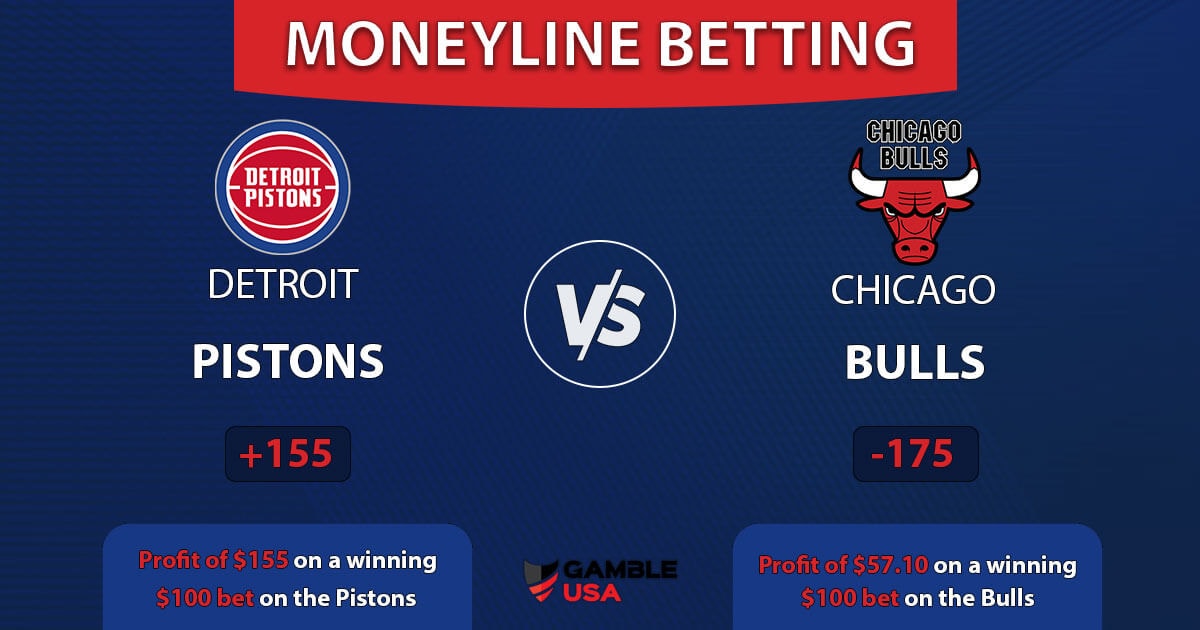

Moneyline Betting Ultimate Guide How To Bet The Money Line

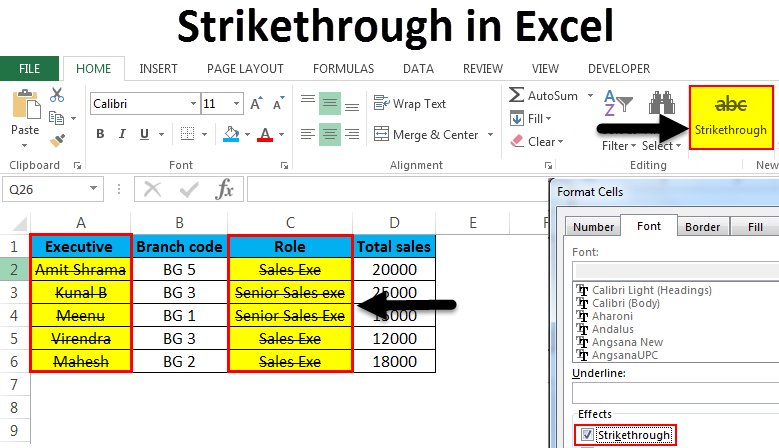

Strikethrough In Excel Examples How To Strikethrough

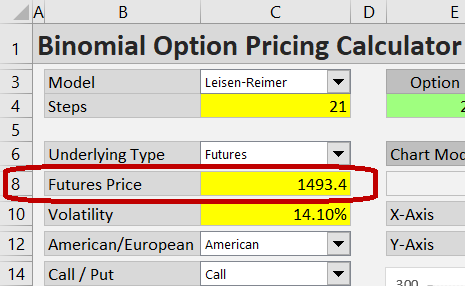

Futures Options Binomial Option Pricing Calculator Macroption

Cotton News Archives Plains Cotton Growers Inc

How To Use The Option Calculator Z Connect By Zerodha Z Connect By Zerodha

Options Profit Calculator Apps On Google Play

Call Option Profit Calculator Free Download